What Is a Cash Balance Pension Plan?

by

Neo Nicholas

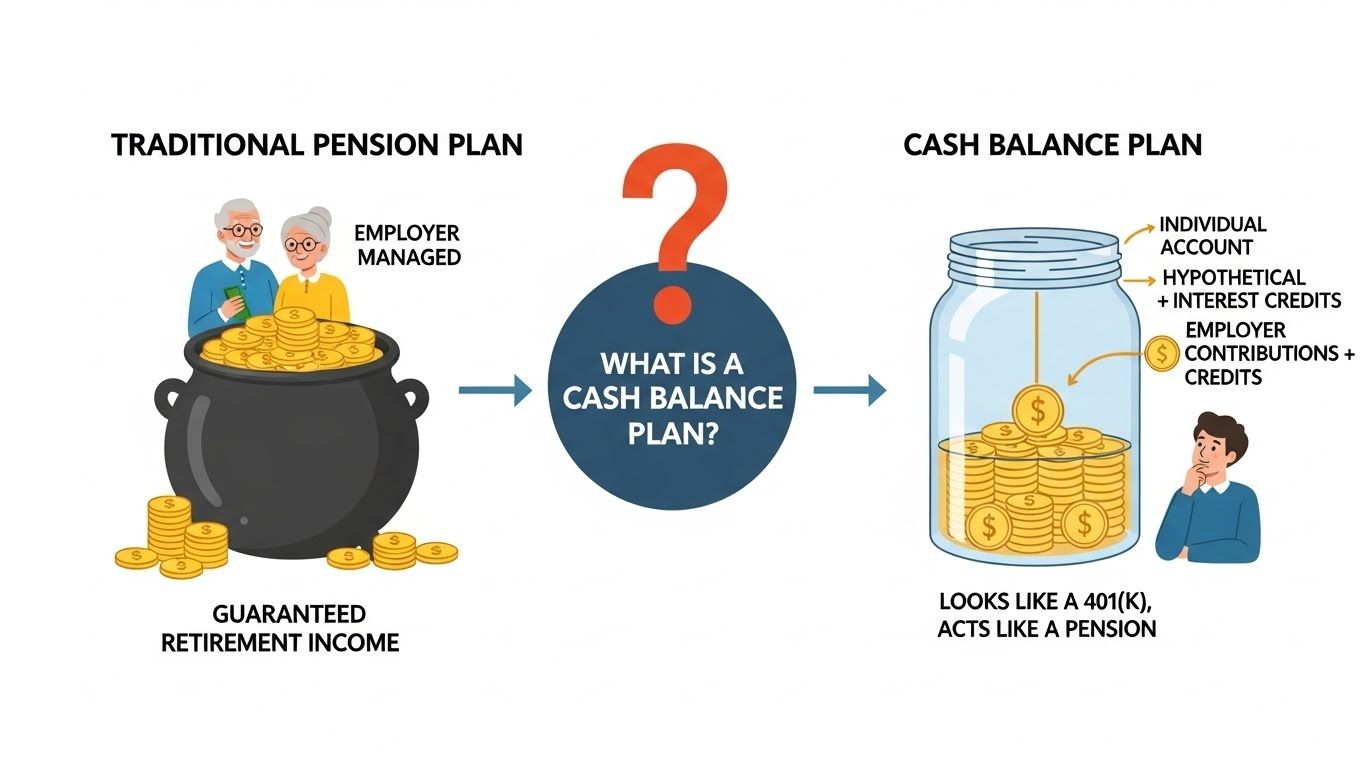

A cash balance pension plan is a hybrid retirement plan like a pension with a 401(k) feel. Employers credit a set % of pay plus guaranteed interest into a “hypothetical” account, offering predictable, high-limit savings ideal for business owners and high earners.

Get Your Pension Calculator Estimate

Cash Balance Pension Plan Explained (Overview)

A cash balance plan is essentially a pension plan with an account-like statement. Each year, an employee receives:

1. Pay Credit

A fixed percentage of salary (e.g., 5%–10%).

2. Interest Credit

A guaranteed rate (often tied to Treasury rates or a fixed rate).

These credits accumulate over time, and at retirement, the employee receives the account balance as a lump sum or annuity.

Cash Balance Pension Plan vs 401(k)

| Feature | Cash Balance Plan | 401(k) |

|---|---|---|

| Type | Defined Benefit | Defined Contribution |

| Employer Contribution | Required | Optional |

| Annual Limits | Very high (up to $300k+ for owners) | Lower (up to $23k + catch-up) |

| Investment Risk | Employer bears risk | Employee bears risk |

| Benefit Predictability | High | Depends on market |

Cash Balance Pension Plan Formula

A typical cash balance plan formula looks like this:

Account Balance = Prior Balance + Pay Credit + Interest Credit

Example:

- Salary = $150,000

- Pay Credit = 5%

- Interest Credit = 4%

Annual credit = $7,500 + interest on prior balance

Cash Balance Pension Plan Example

Let’s say Rahul is 45 years old and earns $200,000 per year. His employer offers:

- Pay credit = 8%

- Interest credit = 4%

Yearly contribution:

- $16,000 + interest Over 10–15 years, Rahul can build a significant retirement balance.

Cash Balance Pension Plan and 401(k)

Many companies offer both a cash balance plan and a 401(k). This combination allows employees to maximize retirement savings:

- 401(k) for flexible contributions and employer matching

- Cash balance plan for large tax-deferred contributions

This is especially useful for high-income earners.

Cash Balance Pension Plan Deduction & Tax Benefits

Employers receive tax deductions for contributions. Employees do not pay taxes on contributions until distribution.

Tax Deduction

Employer contributions are tax-deductible as a business expense.

Taxation

When the employee receives money, it’s taxed as ordinary income.

Cash Balance Pension Plan Distribution Options

Employees usually have options:

- Lump-sum distribution

- Annuity payout (monthly lifetime income)

- Roll over to an IRA or qualified plan

Cash Balance Pension Plan Investment Options

Unlike 401(k)s, employees don’t choose investments. The employer’s plan sponsor manages the investments and guarantees a minimum return.

Cash Balance Pension Plan Pros and Cons

Pros

- Higher contribution limits

- Predictable retirement benefits

- Ideal for business owners and high earners

- Employer assumes investment risk

- Can be paired with 401(k)

Cons

- Complex and expensive to set up

- Employer must fund annually

- Limited flexibility for employees

- Plan may require actuarial services

Cash Balance Pension Plan Requirements

To establish a cash balance plan, a company must:

- Have consistent funding

- Follow IRS rules and nondiscrimination testing

- Hire an actuary

- Maintain annual compliance

What Is the Downside to a Cash Balance Pension Plan?

The main downsides are:

- Cost and complexity

- Required annual contributions

- Less flexibility for employees

- Potential for plan freezes or conversions

Cash Balance Pension Plan Calculator

A cash balance calculator estimates your retirement balance based on:

- Salary

- Pay credit percentage

- Interest credit rate

- Years of participation

If you want, I can generate a custom calculator or spreadsheet for your specific case.

Cash Balance Pension Plan vs Defined Benefit Plan

A cash balance plan is a type of defined benefit plan. The difference is mainly how benefits are expressed:

| Plan Type | Benefit Format | Employer Risk |

|---|---|---|

| Defined Benefit (traditional pension) | Monthly lifetime benefit | Employer |

| Cash Balance | Account balance with guaranteed interest | Employer |

Cash Balance Pension Plan Annuity Calculator

If you want to convert your cash balance into a monthly annuity, the calculation depends on:

- Interest rate assumptions

- Life expectancy

- Plan rules

I can create a personalized annuity estimate if you provide your age and balance.

Frequently Asked Questions (FAQs)

1. Is a cash balance plan better than a 401(k)?

It depends on your goals. For high-income earners, cash balance plans often allow much higher tax-deferred contributions.

2. Can I roll over a cash balance plan?

Yes, typically into an IRA or another qualified plan.

3. Who benefits most from a cash balance plan?

Business owners, partners, and high earners seeking accelerated retirement savings.

4. Do employees get to choose investments?

No. Investments are managed by the plan sponsor.

5. Are cash balance plans risky?

The employer bears investment risk, not the employee.

by Neo Nicholas

Neo Nicholas is a skilled Financial Accounting Expert who supports our Financial Calculators by delivering accurate, practical, and easy-to-understand financial insights. With a strong background in accounting and financial analysis, he helps users make confident and informed money-related decisions.

Expertise & Contribution

Finance-Focused Guidance:

Neo specializes in simplifying complex financial concepts, helping users understand loans, interest, savings, investments, and budgeting with clarity.

Calculator Accuracy & Reliability:

He ensures that our financial calculators provide precise, trustworthy, and user-friendly results for payments, returns, and financial planning.

Smart Financial Decision Support:

His insights help users evaluate real-world financial scenarios, making it easier to plan expenses, manage debt, and grow wealth.

Easy-to-Understand Financial Education:

Neo believes financial knowledge should be accessible to everyone, transforming complicated calculations into clear and actionable information.

Role on TheSmartCalculator

As a key member of our Financial Calculators team, Neo Nicholas enhances the accuracy, usability, and credibility of our tools. His expertise empowers users to analyze their finances effectively and make smarter financial choices with confidence.